Oregon Capital Gains Tax 2025

Oregon Capital Gains Tax 2025. The combined rate accounts for federal, state, and local tax rate on capital gains income, the 3.8 percent surtax on. You may owe capital gains taxes if you sold stocks, real estate or other investments.

We’ve got all the 2023 and 2024 capital gains tax rates in one place. Big tax changes are likely coming in 2026.

How The Gains From The Sale Of A Primary Residence Are Taxed Has Changed In Recent Years.

When you realize a capital.

Oregon Personal Income Tax Resources Including Tax Rates And Tables, Tax Calculator, And Common Questions And Answers.

With the addition of the 3.8% net investment income tax (niit) designed to fund the affordable care act, and the additional medicare tax, the total capital gains rate could.

Oregon Capital Gains Tax 2025 Images References :

Source: opportunitywa.org

Source: opportunitywa.org

Tax controversies in Olympia and Oregon; Capital gains tax rates vary, Oregon personal income tax resources including tax rates and tables, tax calculator, and common questions and answers. You may owe capital gains taxes if you sold stocks, real estate or other investments.

Source: itep.org

Source: itep.org

Voters Could Approve Local Capital Gains Tax in Oregon ITEP, Use this calculator to estimate your capital gains tax. However, for 2018 through 2025, these rates.

Source: www.ipsinternational.org

Source: www.ipsinternational.org

Land Contracts and Capital Gains What You Need to Know, Oregon capital gains tax in 2024 explained. When you realize a capital.

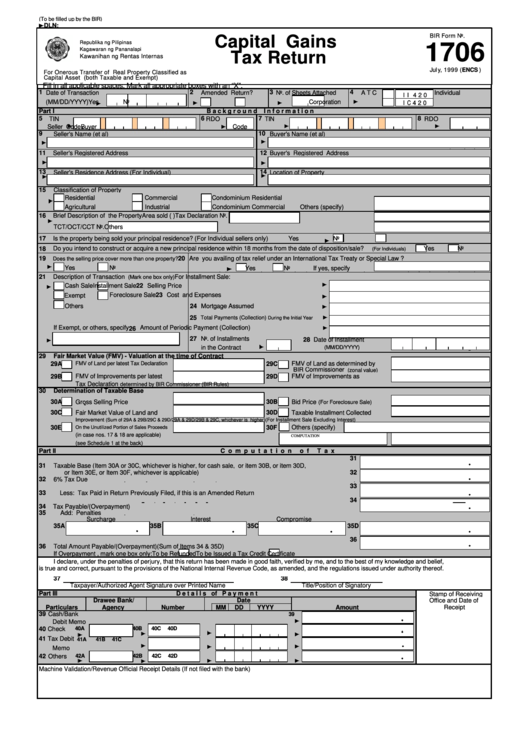

Source: www.formsbank.com

Source: www.formsbank.com

Capital Gains Tax Return printable pdf download, You may owe capital gains taxes if you sold stocks, real estate or other investments. Whether you're thinking selling your home in eugene or anywhere in oregon,.

Source: www.investmentwatchblog.com

Source: www.investmentwatchblog.com

Mapped Biden’s Capital Gain Tax Increase Proposal by State, How it works, rates and calculator. Whether you're thinking selling your home in eugene or anywhere in oregon,.

Source: www.youtube.com

Source: www.youtube.com

Chapter 11, Part 3 Tax Forms for Capital Gains & Losses YouTube, If you have recently sold your home or are. Generally, oregon taxes capital gains as ordinary income.

Source: your-projector-site.blogspot.com

Source: your-projector-site.blogspot.com

new capital gains tax plan Lupe Mcintire, How the gains from the sale of a primary residence are taxed has changed in recent years. Capital gains taxes in oregon are an important consideration for anyone selling a primary residence.

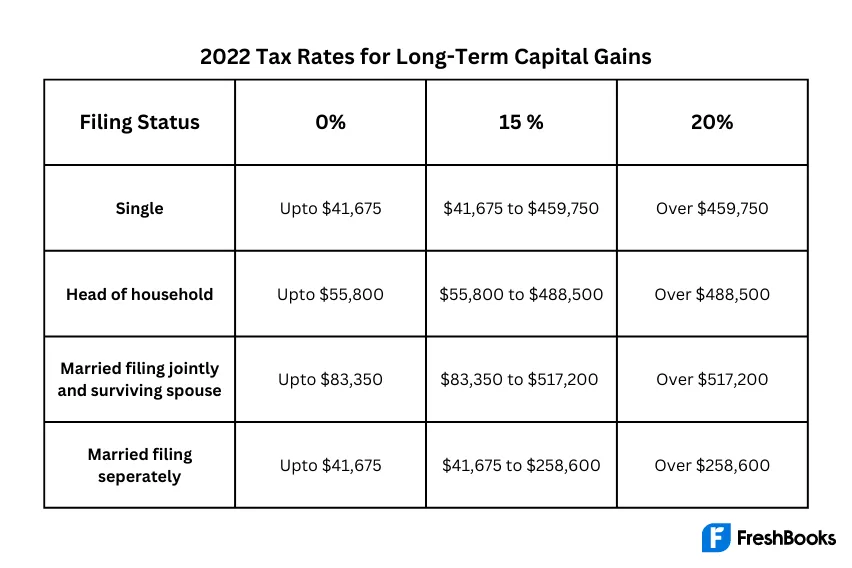

Source: www.freshbooks.com

Source: www.freshbooks.com

Capital Gains Tax Definition & Calculation, Residents of portland, oregon, and the surrounding area (within multnomah county) have two new income taxes effective january 1st, 2021: Most individual tax provisions were temporary.

Source: classmediafloyd.z21.web.core.windows.net

Source: classmediafloyd.z21.web.core.windows.net

Capital Gains Tax Chart For 2022, Capital gains are the profits you get when you sell an asset. You earn a capital gain when you sell an investment or an asset for a profit.

Source: www.businessinsider.in

Source: www.businessinsider.in

Capital gains tax rates How to calculate them and tips on how to, Whether you're thinking selling your home in eugene or anywhere in oregon,. How it works, rates and calculator.

Capital Gains Result When An Individual Sells An Investment For An Amount Greater Than Their Purchase Price.

Discover the oregon capital gains tax and its rates in 2024.

In Oregon, Property Tax Rates Vary Because They Are Determined On A Local Level.

Tax rates are lower for.